I inspired to write this article on this topic due to I see many confusions in my clients regarding taxation in mutual fund. In last July When income tax filled deadline was near and this year they see their mutual fund transactions in their AIS (Annual Information Statement) in Income Tax portal. It was very hard for them to understand how to calculate tax on capital gain of their mutual fund investment.Here I will try to explain Taxation on Capital Gain in Mutual Fund with examples.

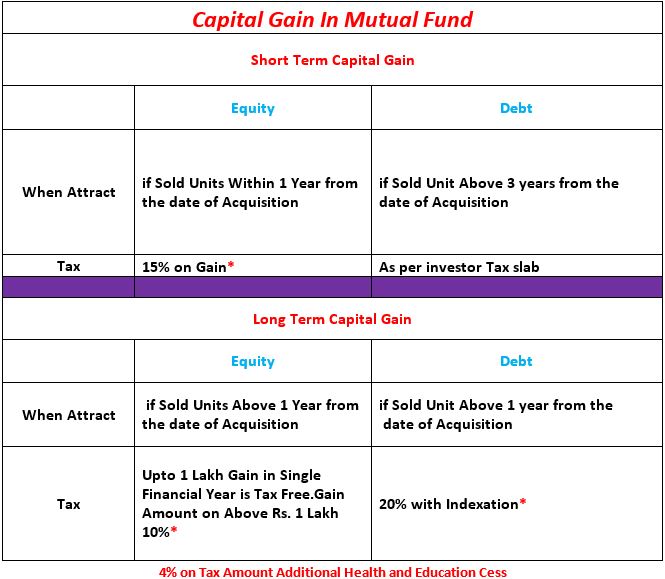

There are two types of gains in Mutual Funds. First is Short Term Capital Gain (STCG) and Secondly Long Term Capital Gain (LTCG).From this which capital gain will attract, it will depend on time horizon you stay invested in single mutual fund scheme and category of this scheme. Below is bifurcation of same.

Let’s see Examples how to calculate Capital Gain Tax In Mutual Fund Equity Mutual Fund Scheme

Short Term Capital Gain Tax in Equity Mutual Fund Scheme:

In the above chart we can see that tax on gain from equity is 15% if sold before 1 year from the date of acquisition. For example if Investor have purchased 100 units of XYZ equity mutual fund scheme of Rs. NAV 15/Unit Dated 15th. February 2022. Then Investor sold that units on 02nd August 2022 at NAV Rs. 16/Unit, So he will have Gain Rs. 1/Unit.Total Gain Rs.100. So, its Equity Scheme and sold within 1 year of acquisition tax rate will be 15% on gain.In above Example Gain is Rs.100 so,Capital Gain Tax will be Rs. 15.

Long Term Capital Gain Tax in Equity Mutual Fund Scheme:

In another scenario with above example if investor sold Units on 13th March 2023.Here it will be above 1 year from Acquisition date.So, it will attract Long Term Capital Gain. Tax on Long Term Capital Gain in equity Mutual Fund is Tax free up to 1 Lakh Gain in single financial year. so in this example there will be No tax on Rs. 100 Gain.Now we will see third scenario where you will have gain above 1 Lakh in single financial year from equity mutual fund scheme. For example say gain is Rs. 1,15,000/- In this case as i said earlier up to Rs. 1 Lakh Gain is tax free so, have to pay tax on only in Rs.15000 At 10% which will be Rs. 1500.

In short in equity Mutual Fund Short Term Capital Gain Tax is 15% and Long Term Capital Gain Tax is 10% on amount above Rs.1 Lakh Gain.

Let’s see Examples how to calculate Capital Gain Tax In Mutual Fund Debt Mutual Fund Scheme

Short Term Capital Gain Tax In Debt Mutual Fund Scheme :

Here we will see example of Debt Mutual Fund to understand Tax on Gain. For example investor have purchased 100 Units of Debt Mutual Fund Scheme of NAV Rs.10/ Unit dated 01st. March 2020 and sold that units on dated 10th April 2022 at NAV Rs. 11.50/Unit. As per Image Above it will attract Short Term Capital Gain Because it sold Within 3 years from the date acquisition.Gain will be (Rs.1.50 per Unit * 100 Units= Rs.150) will be as per tax rate of the investor. in other word there are no special rate for this.Gain will be include in investor income and will be calculate as per Income Tax Slab of the investor.

Long Term Capital Gain Tax In Debt Mutual Fund Scheme:

We will continue above example here. now here we will change only Sell Date. let say If Investor Will sell Units on 05th March 2023 at Rs. 15/Unit, It will be attract Long Term Capital Gain Because There is Gap of More then 3 years from the date of acquisition. Here the Gain will be Rs.500 (Rs. 5 per Unit * 100 Units) and Capital Gain tax will be 20% with Indexation.

First We have to find indexation Cost and Here is the Formula

Cost Inflation Index for the year of sale /Cost of Inflation Index for the year of Acquisition * Cost

for above Example Indexation cost will be 331/289 * 1000 = 1145.32 .

YEAR WISE INDEXATION COST CAN BE FIND HERE

So, Indexation Cost is Rs. 1145.32 and Sold Value is Rs.1500. Capital Gain = 1500-1145 = Rs. 355 on Rs. 355 have to pay 20% Capital Gain Tax.

Here I want to say it is beneficial for higher tax investor because if they invest in fixed deposit or any other fixed income product have to pay as per their tax rate which is currently above 30%.

*Please Note there will Be 4% Health and Education Cess will be Applied on Tax amount. it will applicable on all type of gain tax mention above. For example if your tax amount is 100.additionally Rs.4 will be Health and education Cess.

Thanks for Reading this article. We are dealing in Mutual funds, Life Insurance and General Insurance. If you have any query related to this article OR related to financial and tax planning, you can Contact me Directly Here